Corporate Transparency Act Requires Disclosure of Beneficial Ownership Information

In 2021, Congress passed the Corporate Transparency Act, 31 U.S.C. Section 5336 (the “Act”) which requires the reporting and collection of beneficial ownership information for applicable entities. Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company. The law arises from the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

The Financial Crimes Enforcement Network (“FinCEN”) of the U.S. Department of the Treasury is tasked with implementing rules regarding the Act. On September 29, 2023, FinCEN issued a final rule implementing the beneficial ownership information (“BOI”) reporting requirements. The effective date of the final rule is January 1, 2024.

FinCEN recently published a list of Frequently Asked Questions (“FAQs”) regarding BOI. Below is a brief summary of some of these FAQs:

What is beneficial ownership information (“BOI”)?

BOI refers to indemnifying information about the individuals who directly or indirectly own or control a company. The information includes a full legal name, date of birth, current residential or business street address and a unique identifying number from an acceptable identification document (e.g., passport or driver’s license).

What companies will be required to report BOI to FinCEN?

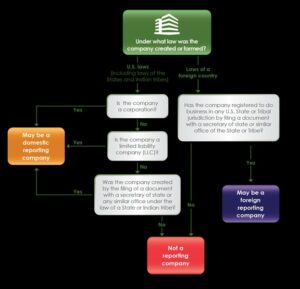

Companies required to report BOI are called reporting companies. There are two types of reporting companies:

- Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

- Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or similar office.

Below is a copy of a chart created by FinCEN depicting what type of companies may be either a domestic or a foreign reporting company.

Are certain companies exempt from reporting BOI? Which companies are exempt from the reporting requirement?

Yes. There are twenty-three (23) types of entities that are exempt from the BOI reporting requirements. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies. The table below summarizes the 23 exemptions:

FinCEN has published a Small Entity Compliance Guide which includes the above table and checklists for each of the 23 exemptions that may help determine whether a company meets an exemption. A link to this guide can be found HERE.

Who is a beneficial owner of a reporting company?

A beneficial owner is an individual who either directly or indirectly: (1) exercises substantial control over the reporting company, or (2) owns or controls at least twenty-five percent (25%) of the reporting company’s ownership interests.

When must the BOI Report be filed?

Reporting begins on January 1, 2024. If your company existed before January 1, 2024, it must file its initial BOI report by January 1, 2025. If your company is created or registered to do business in the United States on or after January 1, 2024, then it must file its initial BOI report within ninety (90) days after receiving actual or public notice that its creation or registration is effective. There is no need or availability of filing a BOI Report prior to January 1, 2024.

For more information on the Corporate Transparency Act, please contact one of these Hellmuth & Johnson attorneys. David Hellmuth, Darbie Tamsett, or Blake Nelson.