Spousal support, spousal maintenance, or alimony can be a complicated process. While every state has its own unique set of laws and standards regarding spousal maintenance, understanding how Minnesota handles this process after a legal separation is essential for those going through a divorce, especially in high-income families. Going into a case, it’s important to know that there is no “formula” or “calculator” for determining spousal maintenance, which can lead to incredibly high – and incredibly low – awards.

If parties cannot agree on spousal maintenance, judges determine awards, and each case is considered unique and different. These types of cases are often highly contested, and judges are granted significant discretion. Thus, both payors and payees have significant risks going to trial.

Due to the nature of spousal support, a well-prepared case is essential for either receiving a fair maintenance award in the case of a payee or keeping the award from being unreasonably high in the case of a payor. High-income families are particularly at risk of an inadequate or excessive award, given the uncertainty of Minnesota law and the potential of implicit bias on the part of a judge.

A judge has significant discretion regarding whether a payee is a candidate for spousal maintenance, the amount of the award, and even how long it should be in place.

First, a judge considers whether a payee is a candidate for maintenance. The central question is whether the payee will either receive sufficient property or is self-supporting to maintain the marital standard of living; however, it is important to note that Minnesota caselaw has determined a payee is not required to invade the principal of assets awarded to them in a divorce. Meaning, a payee is not required to liquidate their property award, and only income-producing assets can be considered by a judge to meet a payee’s needs. In high-income families, investments are often cash-producing assets that could potentially meet a payee’s needs. These investments can be challenging to divide – particularly if vested stock options are associated with a payor’s employment. Further, high-income families often have a high standard of living that cannot be met without a spousal maintenance payment.

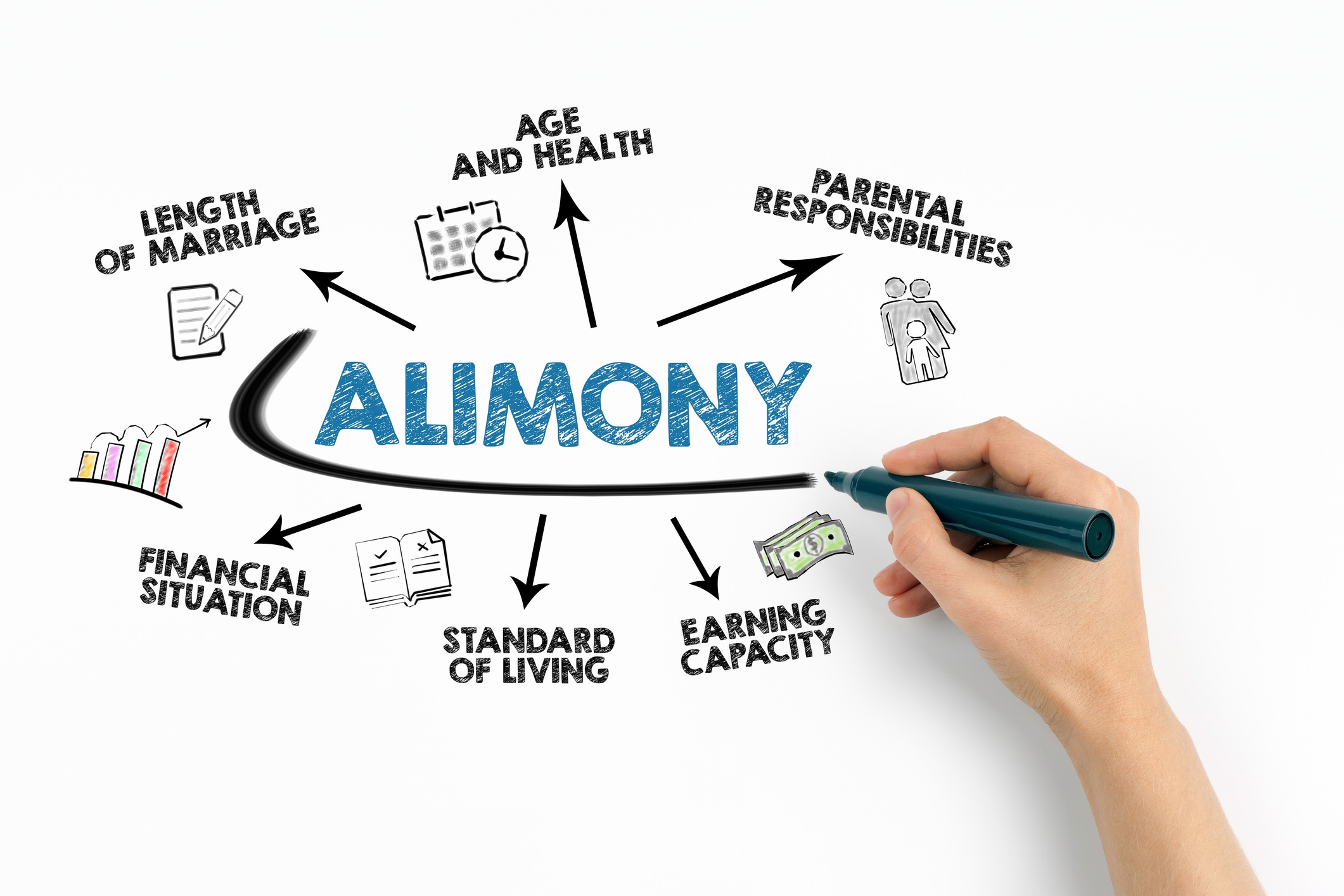

Second, if a judge decides a payee is eligible for spousal maintenance, then the question becomes: how much? In order to determine how much, a judge asks – (1) what the payee’s need is (considering the marital standard of living) and (2) whether the payor can meet that need. There are several factors for a judge to consider, but this is the central dispute: need vs. ability to pay. Not surprisingly, high-income families have high standards of living. Also, not surprisingly, high-income earners can often pay a spousal maintenance award, no matter how high. This is where both payors and payees have significant risks because judges are paid “only” $169,264 a year and can have their own biases. Payees will need to consider whether a judge will believe the marital standard of living is being inflated when it’s not, while payors will need to consider whether a judge will decide they can pay whatever the amount despite the marital standard of living being inflated. A judge can award the payee spousal maintenance in any amount they determine appropriate after considering the totality of the circumstances, creating a great deal of uncertainty.

Finally, a judge must decide the length of time that the maintenance award is in effect. A judge can set spousal maintenance as “temporary” or “permanent.” Temporary spousal maintenance is generally an award with an end date. These awards are often ordered in short-term marriages, when the payee can become self-supporting after a period of time of retraining, or any other reason the judge determines. However, a payee receiving temporary maintenance can bring a motion to extend maintenance before the expiration date if they are not self-supportive at the end date; hence, temporary is not always temporary. Permanent spousal maintenance is an indefinite period awarded in long-term marriages, when the payee cannot become self-support, or for any other reason the judge determines. However, a payor can bring a motion to modify or even terminate permanent maintenance awards if there is a substantial change in need, income, or other reasons like retirement; hence, permanent is not always permanent.

Given the above, it is vital to consider all options regarding spousal maintenance, especially in high-income families. Parties have the opportunity to reach an agreement between themselves to take away the uncertainty of going to trial. However, if parties cannot reach an agreement, they need to be prepared for trial and limit exposure as much as possible. The attorneys at Hellmuth & Johnson are well-prepared to help in both situations. Our attorneys have handled disputes in marital estates ranging from the hundreds of thousands to hundreds of millions of dollars and have the knowledge, experience, and resources to help high-income families move forward with their lives.